Employers Returns IR56A | IR56B | IR56M | Major information

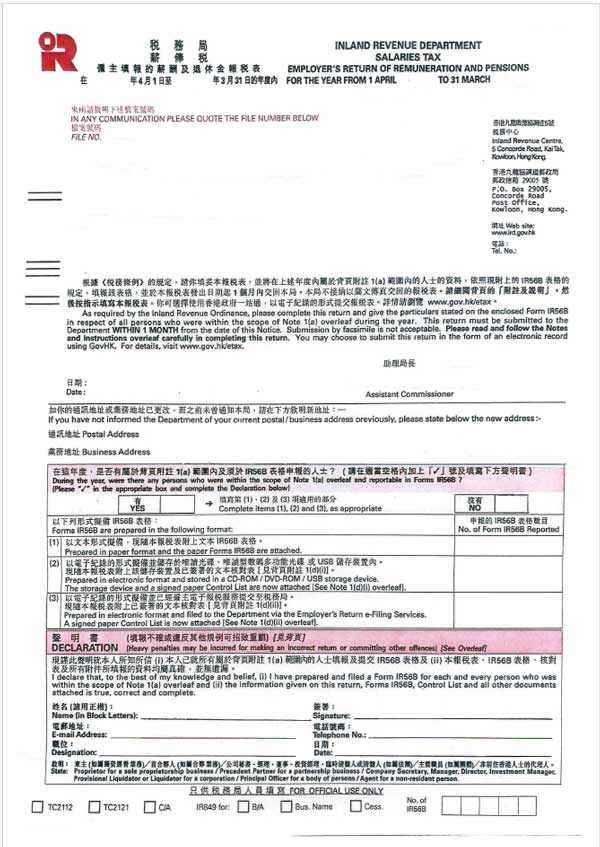

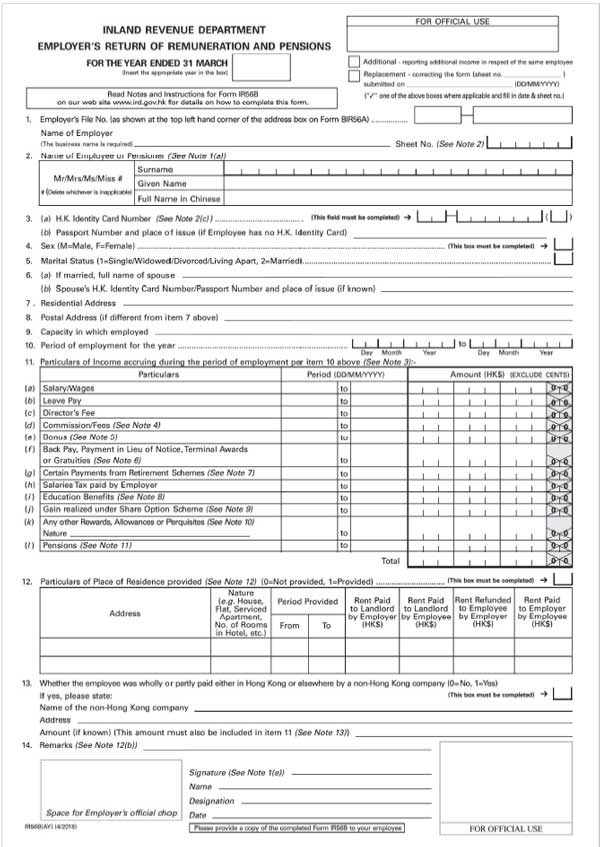

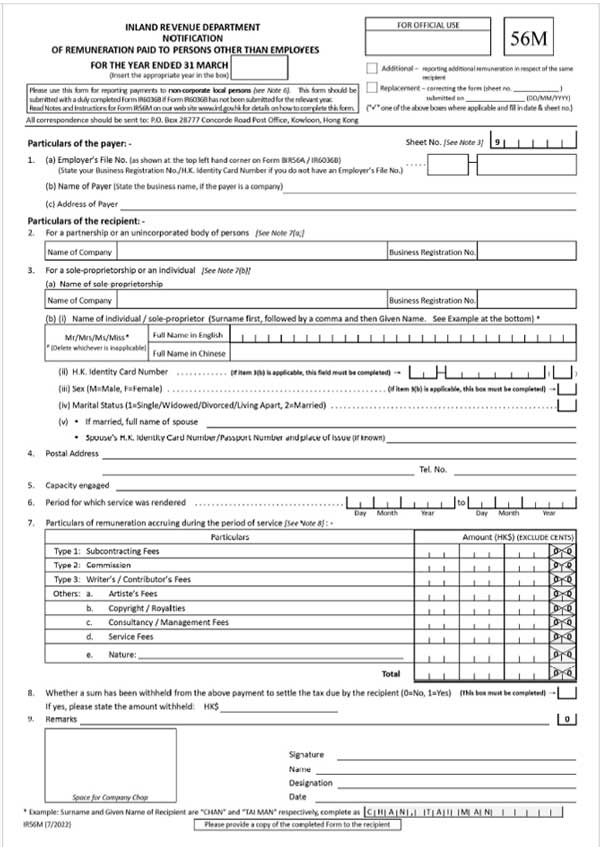

Employer′s Return is required to be filed to Tax Department annually to report staff payroll information every year. Typically encountered are Form BIR56A “Employer′s Returns”, IR56B “Employer′s Returns of Remuneration and Pensions”, and IR56M ” Notification Of Remuneration Paid To Persons Other Than Employees” as described below.

| Form | Description | Details |

|---|---|---|

|

🟢IR56A Employer′s Returns – Summary |

Total staff number | 🟢Total staff number / Number of Form IR56B 🟢Preparer information |

|

🟢IR56B Employer′s Returns of Remuneration and Pensions |

Staff payroll information | 🟢Full / Part time staff – personal particulars 🟢Full / Part time staff – payroll amounts 🟢Directors – personal particulars 🟢Directors – payroll amounts |

|

🟢IR56M Notification of Remuneration Paid to Persons Other Than Employees |

Persons Other Than Employees – Payroll information | 🟢Sub-contractors exceeding $200,000 per annum 🟢Consultants, agents, brokers, freelance artistes, entertainers, sportsmen, writers, freelance guides, etc. in excess of $25,000 per annum |

Attached below are specimen Employer′s Return (IR56A, IR56B, IR56M).

Employers Return | Filing Services

TKLCPA Tax Professionals may assist your Company to handle the Employer′s Return filing, our fee can be as low as $1,500.

Whatsapp / Email us for enquiries and free quotation!

As low as HK$1,500

Contact us to find out details of our Employers Return Filing Services.

Our Services

Find out more about our lines of services